So 2020 wasn’t the year any of us anticipated. It seems to have turned everything topsy-turvy, including people’s plans to spend and save money. If your financial plans took a detour, now is the perfect time to hatch a plan and get them back on track.

Navigating and understanding how you invest money can seem so complicated, however, once broken down, it is much simpler than you realise. And with 45 percent of the MENA region’s wealth in cash deposits in banks, there’s so much opportunity for cash growth with the right tools and knowledge.

StashAway, the digital wealth management platform, has shared its top financial tips for those who are ready to start looking ahead, create a new budget and fulfill their financial goals over the next year. From identifying goals to how to diversify a portfolio, here are five ways you can take control and move forward.

1. Pinpoint your objectives

Most people feel confused when faced with financial planning because they usually don’t know where to start. The first step is to identify your goals and what it is that you want to achieve in life, once that has been done the planning can go ahead.

Whether you want to buy a house in several years, put your children through higher education or move to a different country, you need to know how much money you will need for each of these goals and what you need to do in order to fulfil them.

Financial planning requires creating a timeline for each goal, and you need to determine how much money you will need and when you will need it by. After that, you will be able to find out how much you should be saving each month to reach that goal in the required timeframe.

2. Create your timeline and start investing early

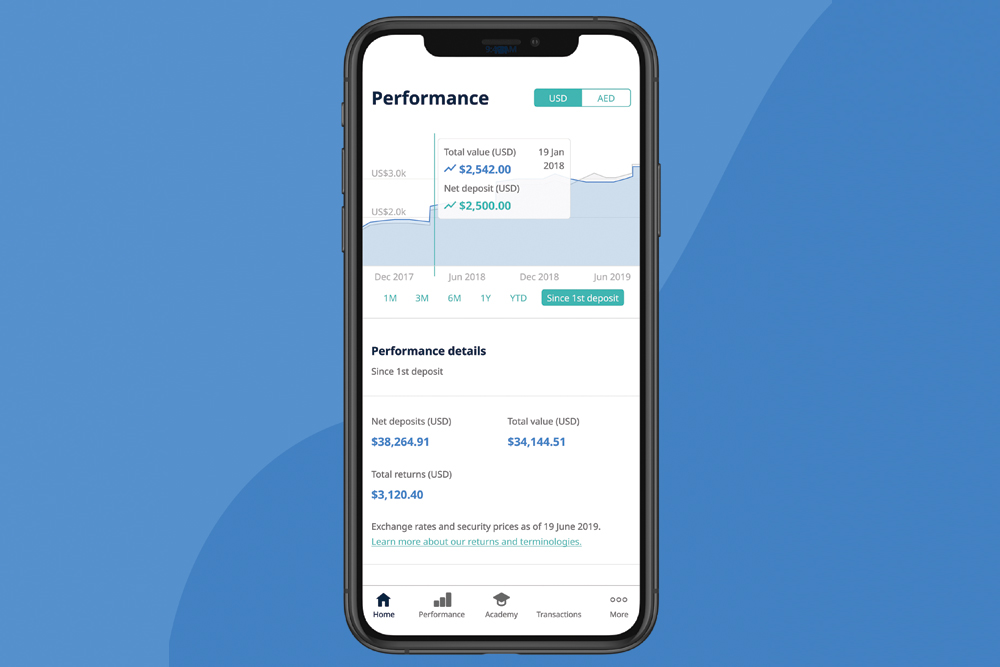

Once you have highlighted your goals and started moving forwards, you should consider investing your money to make it work harder for you. Saving is great, however money that sits stationary in a savings account is ultimately causing you to lose out on money, as there isn’t a chance for those savings to grow.

Investing is a way to allow your money to flourish, and ‘compound interest’, refers to the ‘snowball effect’. Compound interest is the effect of earning interest not only on the money you save (the principle) but also on the accumulated returns you receive every year.

Due to this effect, it’s very important to start investing early. For example, if you want to save $1,000,000 by the time you retire at 65, assuming you started a monthly investment plan that gives you a net return of six percent each year, you will need to start at age 25 with a commitment of $450 monthly. If you wait 10 years and only start at age 35, that amount more than doubles to $952 monthly, that further increases to $2,023 monthly by the time you’re 45 and $5,404 monthly at 55.

3. Broaden your portfolio horizon

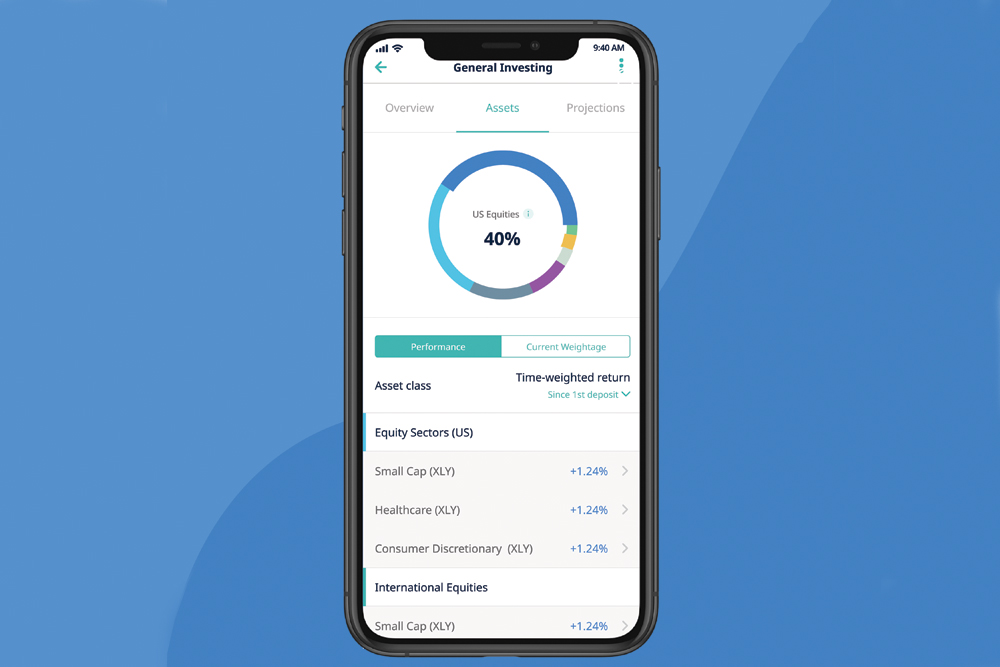

It is really important to diversify your investment portfolio so you can manage risk and reduce the volatility of assets. Your investment portfolio should include various asset classes, and within those exposure to different factors including geographies, sectors, maturity dates and structures should be included. This should be done because if any particular sector was to do badly in any given year, you are protected in other sectors and it will not affect your entire portfolio. Other asset classes that may have done better that year could help balance out or minimise the losses in your portfolio.

Portfolios can be optimised through “asset allocation” and asset classes may include equities (i.e., shares in private companies) around the world, with exposure to a variety of sectors such as technology and consumer staples. It may also include different types of bonds with varying maturities, like short-term and long-term government bonds or investment-grade corporate bonds.

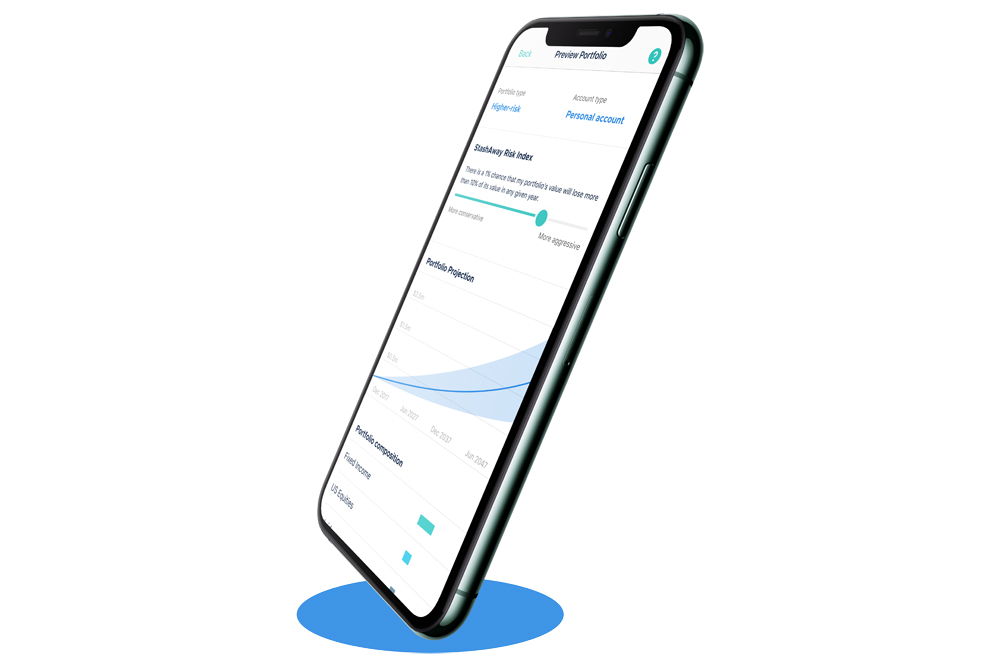

4. Assess the risks and how much you can endure

There will always be some risk when it comes to investing. Usually, the bigger the risk, the bigger the potential return, however this is not always the case if you are factoring in the volatility of an investment. Risk is often measured by its unpredictability, which can be observed by the daily or weekly changes in the price of a resource. The larger the swings in price, the greater the volatility.

For short-term financial goals such as buying a car in three years or buying a house in five, choosing a higher-risk investment product will mean that you will see larger volatility and potentially get lower or even negative returns.

With a short-term investment horizon, you do not have enough time to ride out the inevitable corrections and recessions in the market. In such cases, you should stay conservative in your investments. For long-term financial goals, like a retirement fund that will allow for 10-30 years, you can afford to take more risk. Since you will not need that money for the short term, you can afford to wait out any market issues.

Additionally, it is imperative to build an investment portfolio with a level of risk that you are personally comfortable with. If your portfolio has a risk level that keeps you awake at night, it is probably not right for you.

5. Check your spending

Whether you are looking at your personal spending or the costs of investing, it is important to be aware of the amount of money you have going out, as much as the figures you are seeing coming in. If you aren’t bringing in more money than you are spending, you will need to reassess your personal finances before investing. Fees connected to your investment portfolio will also have a great impact on the returns you receive from your investments, i.e., one percent more fees means one percent less in returns for you, so when evaluating your investment options, you need to look for fees that suit your needs.

Over the last few years, technology has enabled digital wealth managers to disrupt the wealth management industry and the traditional fee structure that has come to define it. The technology-driven automated processes used by digital managers create efficiencies that can be passed on to the investor in the form of lower fees. Typical digital wealth managers charge 1 percent or less per annum and often do not have other fees.

About StashAway

StashAway is a digital wealth management platform that offers investment and cash management portfolios for retail and professional clients. Its technology delivers automated, personalised portfolio management for each client’s individual portfolios. It offers global growth-oriented investment portfolios targeting different levels of risk and StashAway SimpleTM, a straightforward cash management solution. The company that was founded in 2016 in Singapore, and operates in Singapore, Malaysia and the MENA region, was awarded a Technology Pioneer by The World Economic Forum and a Top 10 LinkedIn Startup in 2020.

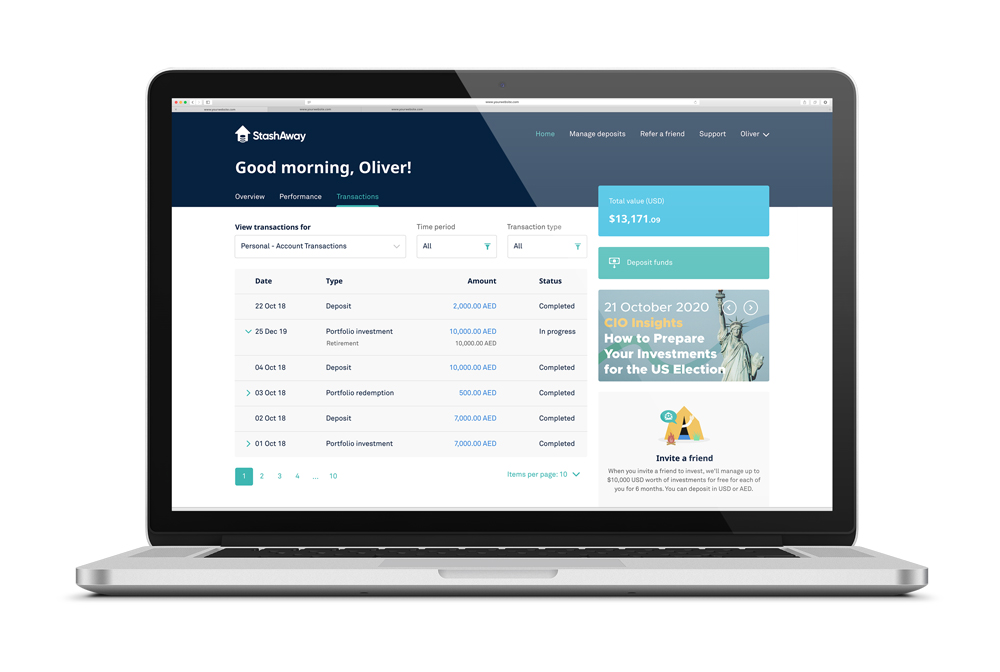

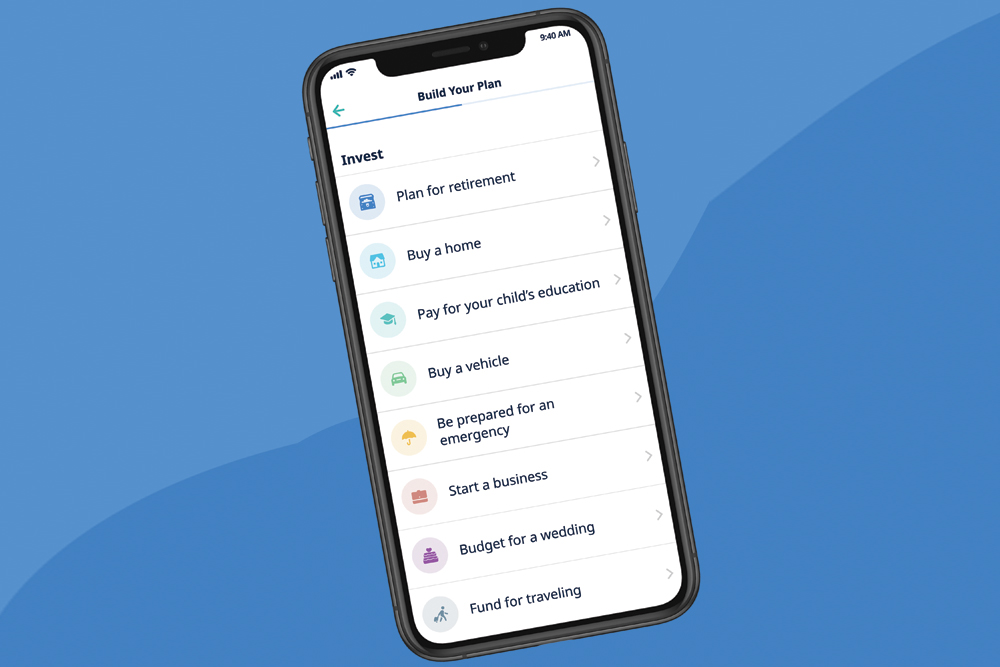

To help you with tip #1, StashAway provides a stress-free solution with its built-in financial planning tool, which makes goal setting as simple as possible. StashAway’s tools will learn about you, your current financial situation, what your financial goals are, and then recommend a monthly savings plan while also building a personalised investment portfolio to help you reach that goal.

Plus, StashAway has a simple fee structure that ranges from 0.2 percent to 0.8 percent, depending on the value of your assets under management. There are no entry or withdrawal fees, no trading fees, no lock-up periods, and you can change your portfolio settings and deposit whenever you want.